What are synthetic indices/synthetic indices trading?

Synthetic indices are unique indices/financial instruments that imitate the behavior of real world market movement of other instruments but are not affected by the real world events.

Synthetic indices are based on cryptographically random number generator making them free from real world market liquidity risks but are constantly volatile. Synthetic indices are active 24/7,meaning that even on weekends traders are able to have access to the platforms that offer them and trade.

Types Of Synthetic Indices

1.Volatility Indices

This type of synthetic indices corresponds to simulated markets with constant volatilities of 10%, 15%, 25%, 30%, 50%, 75%, 90%, 100%, 150%, and 250%.

One tick is generated every two seconds for volatility indices 10, 25, 50, 75, and 100.One tick is generated every second for volatility indices 10 (1s), 15 (1s), 25 (1s), 30 (1s),50 (1s), 75 (1s), 90 (1s),100 (1s), 150 (1s), and 250 (1s)

You can trade the Volatility Indices on the deriv platforms of Deriv MT5 ,Deriv X and Deriv ctrader.On deriv MT5 and Deriv X you can trade the following volatility indices volatility 10 (1s) index, volatility 25 (1s) index, volatility 50 (1s) index, volatility 75 (1s) index, volatility 100 (1s) index, volatility 150 (1s) index, volatility 250 (1s) index, volatility 10 index, volatility 25 index, volatility 50 index, volatility 75 index and volatility 100 index. While if you choose to trade with the deriv ctrader, you can trade also volatility 15 (1s) index, volatility 30 (1s) index and volatility 90 (1s) index

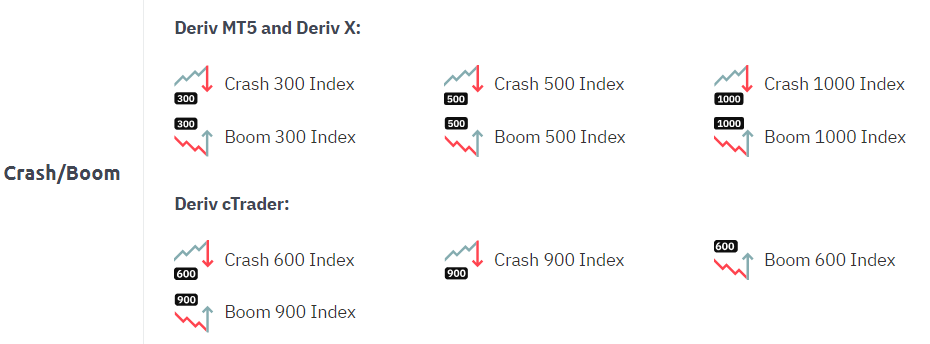

2.Crash/Boom Indices

With these indices, there is an average of one drop (crash) or one spike (boom) in prices that occur in a series of 300, 500, 600, 900 or 1,000 ticks.You can trade the Range Break Indices on the deriv platforms of Deriv MT5 ,Deriv X and Deriv ctrader.

On deriv MT5 and Deriv X you can trade the following crash/boom indices. You can trade crash 300 index, boom 300 index, crash 500 index, boom 500 index, crash 1000 index and boom 1000 index.

While if you choose to trade with the deriv ctrader, you can trade also crash 600 index, boom 600 index ,boom 900 index crash 900 index

3.Step indices

With this type of indices, there is an equal probability of up/down movement in a price series with a fixed step size of 0.1.Under step indices there is only step index and can be traded on the deriv platforms of Deriv MT5 and Deriv X

4.Jump Indices

This type of indices correspond to simulated markets with constant volatilities of 10%, 25%, 50%, 75%, and 100%.There is an equal probability of an upward or downward jump every 20 minutes on average. The jump size is around 30 times the normal price movement, on average.

Jump Indices include Jump 10 index, Jump 25 index, Jump 50 index, Jump 75 index and Jump 100 index. You can trade the Jump Indices on the deriv platforms of Deriv MT5 and Deriv X

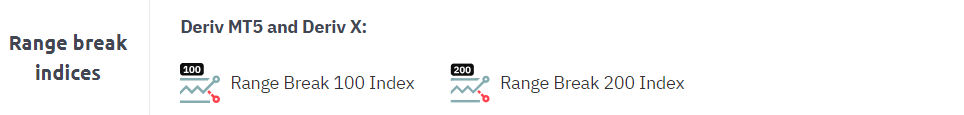

5.Range Break Indices

This type of synthetic indices fluctuate between two price points (borders), occasionally breaking through the borders to create a new range

They make occasional breaks on average once every 100 or 200 times that they hit the borders. Range Break indices include Range break100 index and Range break 200 index.

You can trade the Range Break Indices on the deriv platforms of Deriv MT5 and Deriv X.

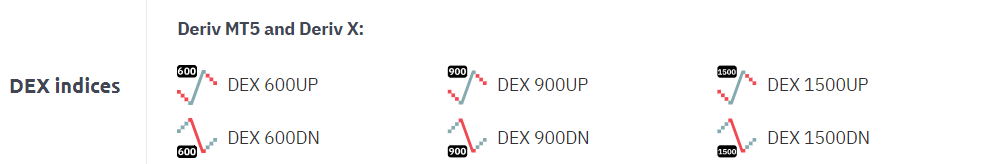

6.DEX Indices

This type of synthetic indices corresponds to simulated markets where assets spike or drop due to news events. They make occasional small movements and major spikes and drops

DEX Indices include DEX600UP,DEX600DN,DEX900UP,DEX900DN,DEX1500UP and DEX1500DN

DEX600UP has frequent small drops and occasional major spikes, which occur every 600 seconds on average while DEX600DN has frequent small spikes and occasional major drops, which occur every 600 seconds on average.DEX900UP has frequent small drops and occasional major spikes, which occur every 900 seconds on average while DEX900DN has frequent small spikes and occasional major drops, which occur every 900 seconds on average.DEX1500UP has frequent small drops and occasional major spikes, which occur every 1,500 seconds on average while DEX1500DN has frequent small spikes and occasional major drops, which occur every 1,500 seconds on average

You can trade the DEX Indices on the deriv platforms of Deriv MT5 and Deriv X

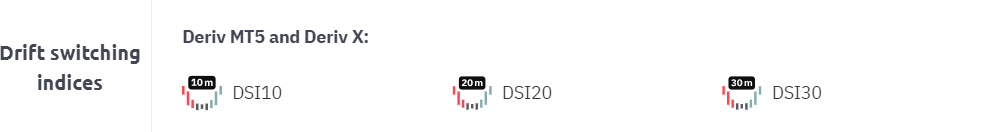

7.Drift switching indices

This type of synthetic indices imitates market trends with asset price going through three regimes, that is

bullish trend, you can call it positive drift regime

bearish trend, you can call it the negative drift regime

sideways movement, you can call it the driftless regime.

Drift switching indices include,DSI10,DSI20 and DSI30.the difference between them is the average time it takes to switch in the above mentioned regimes of positive drift regime, negative drift regime and the driftless regime.

The DSI10 switches between regimes every ten minute on average. The DSI20 switches between regimes every twenty minutes on average. The DSI30 switches between regimes every thirty minutes on average.

You can trade the Drift Switching Indices(DSI) on the deriv platforms of deriv MT5 and deriv X.

Synthetic Indices Vs Stock Indices(Traditional Indices)

Some people tend to confuse synthetic indices to traditional indices like Nasdaq, Dow jones, etc. while others even tend to mistake the volatilities for the VIX of the traditional markets. Synthetic indices are different from the traditional indices and following are characteristics you should know that differentiates the two categories.

traditional indices like the Nasdaq ,US500,etc do consist of companies that actually make them up and the fluctuation of their prices comes from the performance of companies that make them. An example is if majority of the major and large companies in the traditional indices are performing well, the price of the indices is most like going to rise too, vice versa is true too.

while on the side of synthetic indices, their performance is based on cryptographically random number generator making them free from real world market liquidity risks but are constantly volatile. The synthetic indices also do operate 24/7 meaning a trader can also trade them over the weekend unlike the traditional indices that operate 24/5.

Characteristics Of Synthetic Indices

- Operate 24/7.

synthetic indices allow traders to trade 24 hours and 7 days of the week and holiday unlike traditional indices. This allows traders to engage in trading them without differences in the world time difference and also other geographical factors.

- Minimal required capital and maintenance costs

the costs to operate while trading synthetic indices are low compared to while trading other instruments because most of the charge like spreads are constant and less fluctuative.

- Not affected by economic releases that could affect other instruments. This makes synthetic indices suitable even for people who are busy and have less time to keep checking for release dates and time of economic events

- fast order execution and deep liquidity at all times, which is attractive for all traders, whether small or large

- Easy methods of transactions to do both withdraws and deposits

- Reduced trading hinders and restrictions that may pend a lot to someone to start trading

Where To Trade Synthetic Indices

If one wants to trade synthetic indices, will have to register or sign up with deriv broker as its the only broker that does offer the services of trading synthetics. Although they do not only offer synthetics they also do offer financial cfds like forex and commodities, as long as you select the type of account

How To Start Trading Synthetic Indices

Just like any other type of markets, for one to engage in them should understand the risk that comes with trading, then acquire the required knowledge or understanding of how to approach them.

one needs to first learn how to trade and acquire necessary knowledge then open up a practice account with a broker in this case Deriv as its the only broker that offers synthetic trading. Open a demo account with Deriv and practice with an unlimited amount of virtual funds.

Before going to a live account, set up a clear set of trading rules that you will stick to. how you will approach your trades which includes, timeframes to determine structure, entry timeframe, what you will consider for entry, exits, etc.

Platforms To Trade Synthetic Indices On Deriv

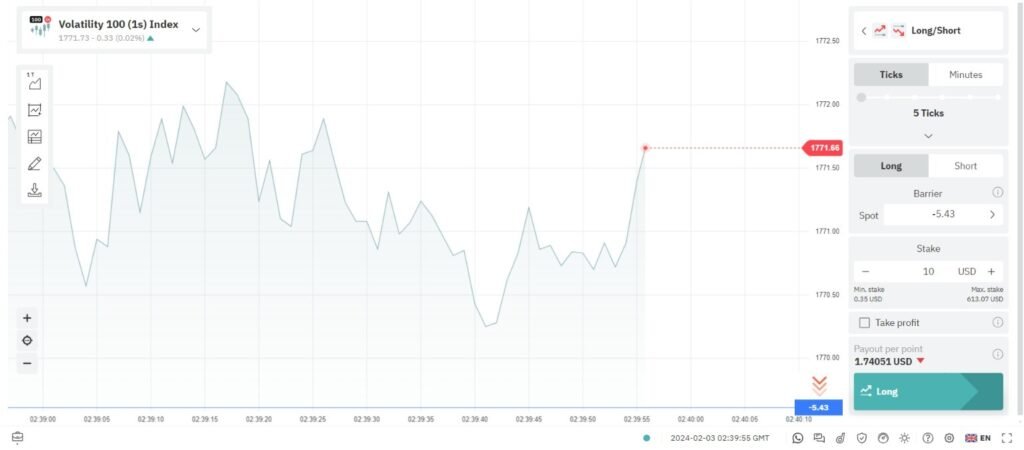

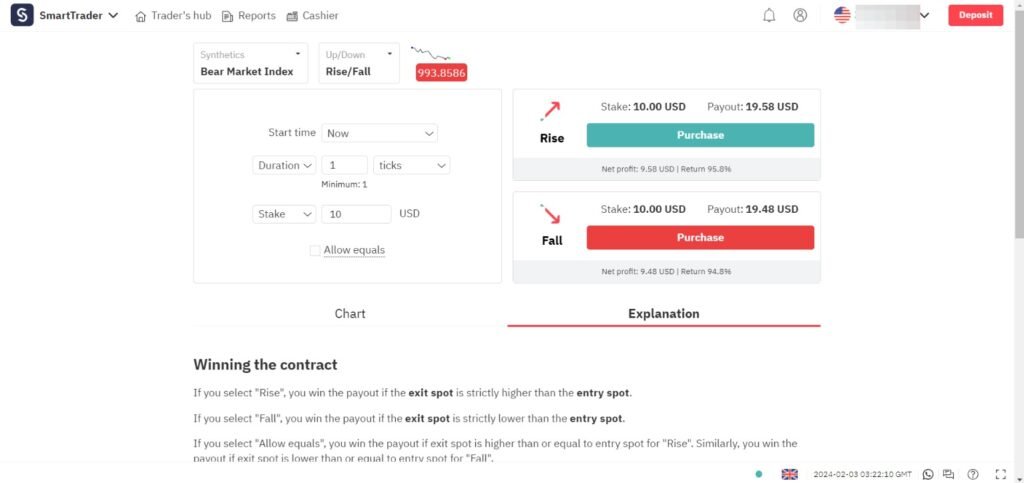

DTrader

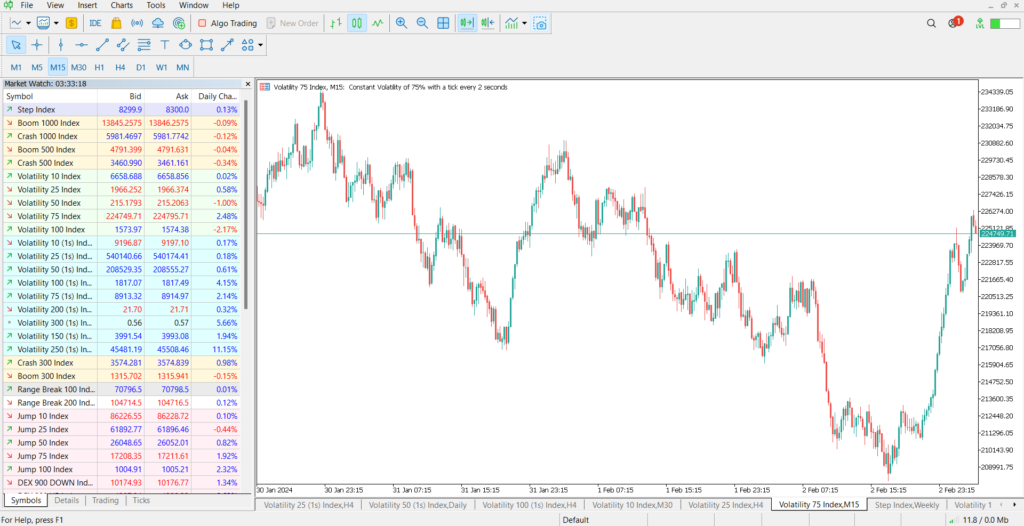

Deriv MT5 (DMT5)

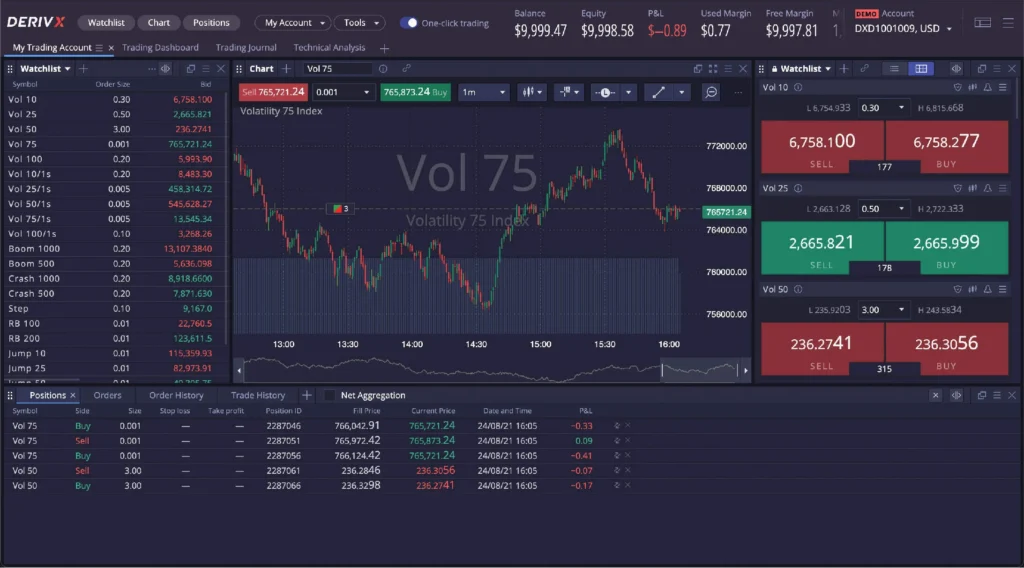

Deriv X

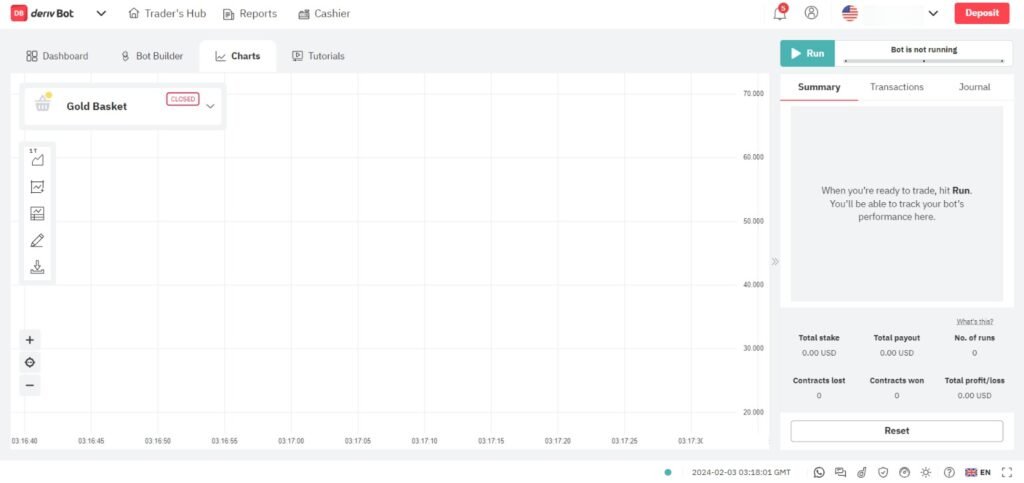

DBot

SmartTrader

Read also: How to create a deriv account.